Resources

Ticketing insights from the Niagara region.

INTENTIONS TO VISIT THE US HAVE DECLINED AMOUNT INTERNATIONAL AUDIENCES – AND THE POTENTIAL IMPACT ON CULTURAL ENTITIES LOOMS LARGE (DATA)

article - usA - POSTED jun 26 2025

D A T A & A N A L Y S I S

In anticipation of a new administration taking office, the United States began to suffer a steep decline in its perception as a desirable travel destination among international audiences.

Here’s a look at the most recent data, and what this means for museums and performing arts organizations.

In our article at the turn of the year, Four Trends We’re Watching in 2025 for Cultural Organizations, (https://www.colleendilen.com/2024/12/18/four-trends-for-2025/) we showed data on an alarming trend for cultural organizations: The decline in intentions to travel to the United States for leisure purposes. Other outlets are now reporting on these trends as well. (https://www.washingtonpost.com/business/2025/03/16/international-tourism-travel- trump-canada/)

IMPACTS Experience (http://www.impacts-experience.com) monitors 224 visitor-serving organizations in the United States – from aquariums to historic sites to symphonies – and we know that attendance from international audiences regularly comprises 7-12% of total annual attendance for many organizations. This represents a large number of visitors!

Let’s state the obvious: It’s been a busy first quarter in terms of newsworthy happenings in the United States. IMPACTS Experience has noted several dramatic changes in intentions to visit cultural entities, as well as their reputations and welcoming perceptions. Some metrics that have been considered relatively durable – or even on the rise such as trust perceptions – may look very different when this current quarter comes to a close. We look forward to publishing data on some of these changes starting next month. In the meantime, this article focuses on a trend we’ve already observed that risks further decline…so please consider these data as a baseline against which to chart changes as the year progresses.

The research in the charts below updates intentions and preferences to visit the US among nearly 3,600 Western European (and United Kingdom) adults at the end of year 2024. While, of course, this international visitation audience subset does not include all international visitors to the United States, we are looking at this audiences because it illustrates a trend we are seeing from other audiences as well, and European (+UK) travelers make up a meaningful number of international visitors to US cultural organizations beyond North America. Indeed, for many organizations, European visitation regularly comprises nearly half of their international visitation. Their attitudes and perceptions often serve as a bit of a canary in the coalmine-like harbinger of emerging global views. In other words, European attitudes are often a leading indicator of broader perceptions.

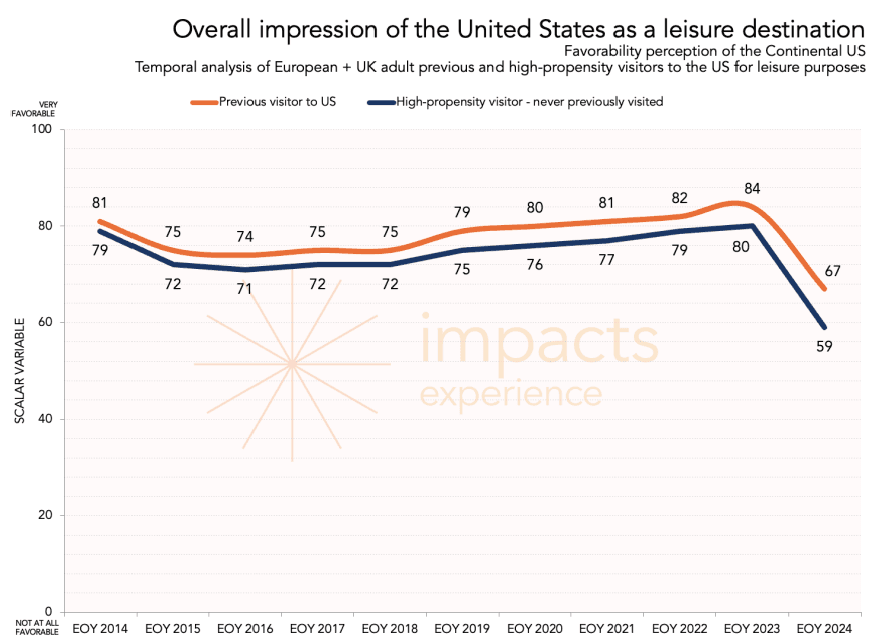

The overall impression of the United States as a leisure destination has decreased

The data below are quantified as scalar variables on a 1-100 scale wherein 100 represents a very favorable impression and 0 represents a not at all favorable impression. As regular readers know, an increase or decrease of even one point is often noteworthy and two points is significant.

The orange bar represents the sentiments of individuals who have previously visited the United States for leisure purposes, and the blue bar represents high-propensity visitors who have not previously visited the United States. A high-propensity visitor (https://www.colleendilen.com/2019/01/23/active-visitors-currently-attends-cultural- organizations-data/) is someone who has the demographic, psychographic, or behavioral characteristics to suggest that they are a particularly likely attendee to a cultural organization. In short, these are the folks who have – or profile as having – any interest at all in attending a museum or performing arts entity.

(https://www.colleendilen.com/media-usage-policy/)

The overall impression of the United States as a leisure destination dropped precipitously from the end of year 2023 to the end of year 2024. This decrease was born of uncertainty surrounding the outcomes of this unique US election. (You’ll note that this dramatic decline in perceptions did not take place in previous election years.) These concerns range from the administration’s stances on items ranging from gun control to strengthening the US dollar (https://www.nytimes.com/2024/11/14/business/strong-dollar-trump.html) – conditions that risk making international travel to the US less favorable.

This question was not posed as an if/when query. We didn’t ask, “If Donald Trump wins the election, what will your overall perception be of the US as a favorable leisure destination?” or “Now that Donald Trump has won the election, how favorable is your view of the US as a leisure

destination?” We didn’t frame the question with mentions of the administration at all. We simply inquired as to the overall impression of the US as a leisure destination. The results were not encouraging – and, pointedly, are dramatically worse than any other year as observed during the past decade.

Previous visitors are endorsing a visit to the United States at depressed levels.

Let’s dive deeper into those folks who has already made the decision to travel to the United States for leisure purposes. For them, the US had risen to the top before as a desirable destination such that they packed their bags and made the trip – and hopefully some positive memories as well!

Endorsements from past travelers to the United States are critical for encouraging others to make the trip. In general, earned endorsements are critical for motivating behavior. (https://www.colleendilen.com/2015/09/02/how-social-media-drives-visitation-to-cultural- organizations-fast-fact-video/)

(https://www.colleendilen.com/media-usage-policy/)

Again, a difference of even one number is noteworthy – and at 61, past visitors are closer to discouraging others from visiting the US than endorsing a trip.

This is a problem. Tracking this helps us understand the depth of the US’s changing reputation and helps us to consider how pervasive these perceptions may be. Endorsements and referrals are especially important because there is generally a long lead time for international audiences planning a trip to the US for leisure purposes.

As a reminder, these data run through the end of 2024 – before many potentially worrisome polices and practices that international visitors found alarming were actually implemented. How these data outcomes will evolve is yet to be seen, and we may all agree that – regardless of our personal politics – the first quarter of 2025 may not be the most reliable for long-term planning. How durable or ephemeral these attitudes may prove to be remains unknowable in the immediate near term – these are unprecedented times.

International visitors often start planning their trips to the US months or even years in advance. Thus, these negative perceptions are likely to impact travel right now, but they may also linger and put the US further down on the list of desired leisure destinations for a trip for the foreseeable future.

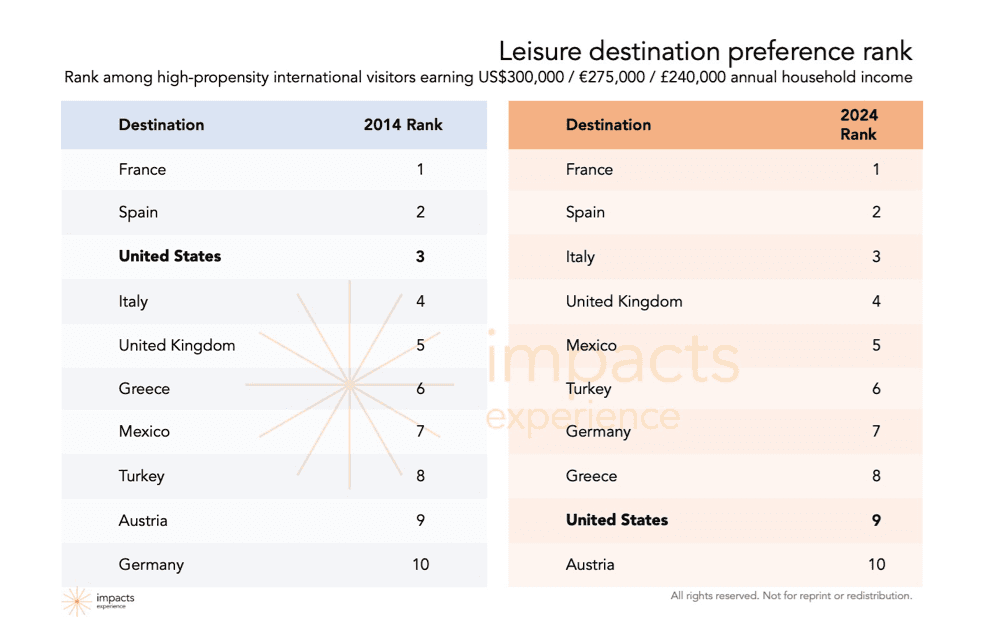

The preference for the United States as a desired leisure destination has sunk dramatically.revious visitors are endorsing a visit to the United States at depressed levels.

Speaking of a “list of desired leisure destinations for a trip,” we’ve seen some big changes among Western European and UK audiences.

Here’s that list. However, we’ve segmented the data for high-propensity visitors (because we’re aiming to understand potential impacts for cultural entities) who earn more than

$300,000/year.

“Holy mackerel,” you may be thinking. “That’s a limited subset!” Well, not really. When it comes to contemplating international visitation, this is a somewhat unique cohort to begin with. And this is because we’re aiming to understand destination preference in the particular chart below, without responses being skewed by destination affordability. Think of the question, “If you could go anywhere in the world, where would you go?” The $300,000 cohort is approximately equivalent to a top 5% US income level. People in this household income bracket generally have fewer financial limitations and more discretion in terms of choices of leisure pursuits.

To be clear, international visitors who are not in this income bracket are also extremely important. But for the sake of this particular article exploring changing perceptions of the United States, we want to know preferences among those who have the most options.

(https://www.colleendilen.com/media-usage-policy/)

Though it may not seem to be the case at first, we at IMPACTS Experience consider this research outcome to be particularly devastating. To drop from third in 2014 to ninth in 2024 is dramatic.

Do you want to know something even more alarming? This hasn’t been a decline over the last ten years. Far from it. The United States was second on this list in 2022 and 2023! It dropped to ninth in 2024. The United States is losing previously claimed ground – and we are already seeing evidence of acceleration in this decline within the first three months of the year.

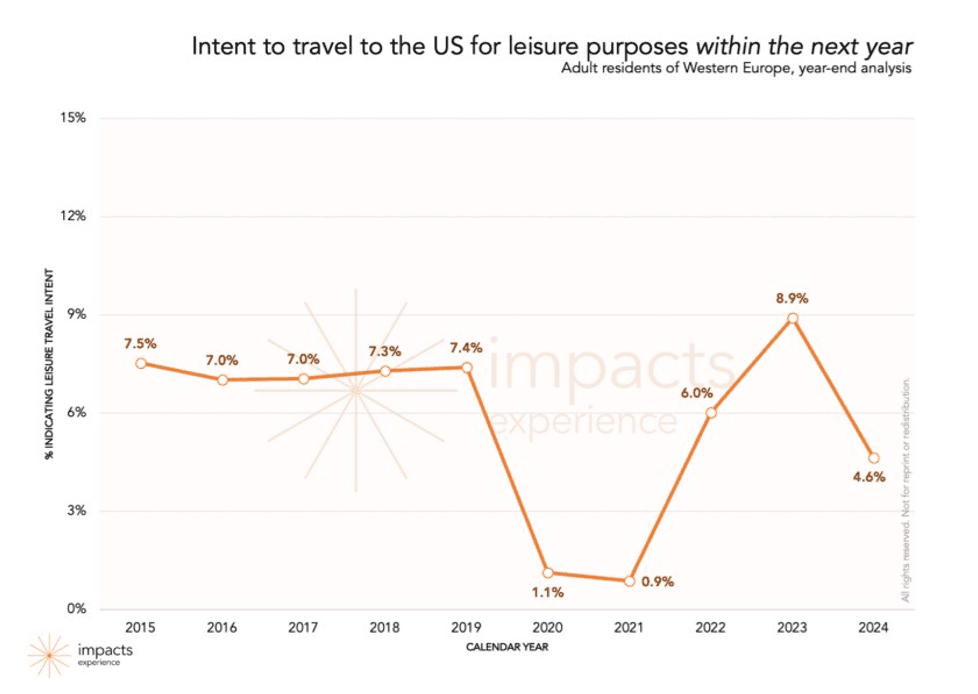

Intentions to visit the United States have dramatically decreased.

Finally, let’s revisit the data that we previously shared (https://www.colleendilen.com/2024/12/18/four-trends-for-2025/) on intentions to travel and provide additional context.

These data indicate end-of-year intentions to visit the United States during 2025. For instance, the data at year-end 2023 indicated the percentage of Western European adults who intended to visit the United States during calendar year 2024.

(https://www.colleendilen.com/media-usage-policy/)

The findings are alarming. The percentage of adult residents in Western Europe who intend to visit America in 2025 is nearly half that of those who intended to visit in 2024. If these sentiments and intentions prove durable, US organizations are likely to welcome far fewer international travelers in 2025 than in any recent year other than those most affected by the pandemic.

As a reminder, the percentage of international travelers from Western Europe intending to visit the US in 2020 and 2021 was exceptionally low due to COVID-19-related travel restrictions. Excitingly, 2024 was a comparatively great year for international guests from Western Europe…but these data strongly suggest we should not bank on similar performance in 2025.

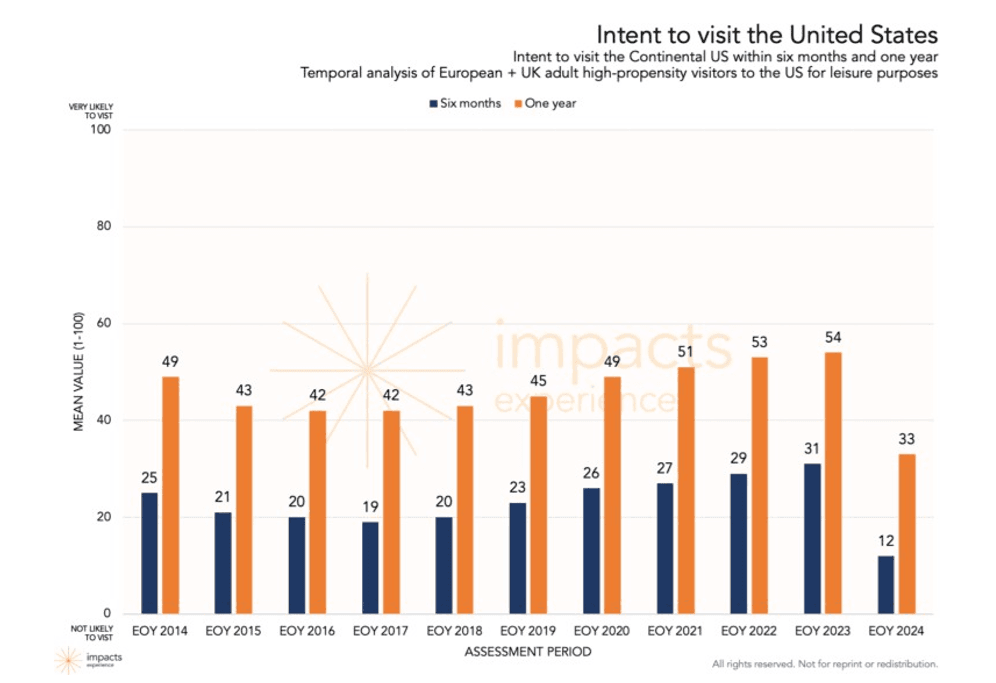

The next chart examines the mean value of intentions to visit within the next six months, and also within the next year. It measures the strength of the intention. Here, a value approximating 100 indicates “very likely to visit.” The highest values here are for folks who are walking in the door! A value of 1 indicates “not likely to visit at all…ever.” The lowest value folks simply aren’t planning a visit. They aren’t coming.

(https://www.colleendilen.com/media-usage-policy/)

It stands to reason that visiting within the next year is a higher value simply due to the grace of a more elongated chronology of opportunity. Folks visiting within the next six months may already have their airline tickets if they intend to come to the United States and are fleshing out their desired itineraries.

Needless to say, plans to visit the US in 2025 – as of end-of-year 2024 – were the lowest on record. Note that intentions remained high during the pandemic years as folks rather optimistically hoped to visit in the upcoming year. (Remember when we thought the pandemic would last a mere few weeks or months? Oh, the good ol’ days when optimism amidst tragedy reigned supreme!)

What does this mean for cultural organizations?

Fewer international tourists visiting the US means fewer international tourists making their way through the doors of cultural organizations.

Losing international guests is especially painful because international travelers tend to be less price-sensitive than more local or regional domestic guests. This often manifests itself as more money spent on food and retail, especially for audiences with the desire to memorialize their visit.

The currently observed plummet in intentions to visit the US for leisure purposes is at minimum both noteworthy and cautionary. We will continue to monitor these metrics closely throughout the coming year. However, as foreign travel often requires a long lead time, it’s worth noting that once people remove an activity from their planning processes, returning to that activity can require time. The sustained risk in the interim is that potential foreign visitors will habituate to domestic activities in their home countries – and a significant investment will be required to reacquire these audiences.

Visits from international tourists are at-risk, and this has implications for attendance planning and projections. While there is not an easy “fix” for this condition, understanding the happenings of our macroenvironments aids in more effective planning.

The first quarter of 2025 is about to end. And with it comes our first formal look at data outcomes and where things stand since changes to the US administration and attendant policies have started to influence public perceptions. It’s important to note that these data outcomes are not borne of emotion or political preferences on the part of our data collection teams or partners. Rather, they represent data carefully collected in an unbiased manner.

You may be angered by the desires and action of the new administration. You may love them. Either way, here’s where things stand in terms of international travel intentions and US perceptions – and how they stand to impact attendance to cultural organizations this year.

Yours in expert analysis, real-time trends, and high-confidence research, IMPACTS Experience

Published on: 03/12/25

Sample Pet Policy - Performing Arts Venue

POLICY - CANADA - POSTED Feb 20 2025

Purpose

The Pet Policy establishes guidelines for bringing, caring for, and supervising pets in the workplace. We recognize the benefits of pets in fostering a friendly and positive work environment. However, we also have a responsibility to ensure that pets do not disrupt business operations, pose health or safety risks, or cause discomfort to employees.

This policy is designed to comply with the Employment Standards Act (ESA), the Occupational Health and Safety Act (OHSA), and the Accessibility for Ontarians with Disabilities Act (AODA). Service animals, as defined under the AODA, are exempt from certain restrictions outlined in this policy.

Scope

This policy applies to all employees, contractors, and consultants in any space owned or leased by the company where employees perform their job duties.

Policy Elements

Employees who wish to bring pets to the workplace must:

- Obtain prior approval from the HR department.

- Provide proof that their pet is well-trained, properly vaccinated, free of parasites, and does not pose a health or safety risk.

- Sign an agreement acknowledging their responsibilities for their pet's behavior and well-being.

Allowed Pets

- Generally, well-trained dogs and cats are permitted.

- Exotic animals such as snakes, spiders, or rodents, as well as any pet that poses a potential hazard, are prohibited.

- Young, untrained, or aggressive animals are not allowed.

- All pets must be on a leash or contained when outside of their owner's workspace.

- Sick pets should remain at home.

Owner Responsibilities

Employees must:

- Clean up after their pet and ensure hygiene standards are maintained.

- Supervise their pet at all times and prevent disruptive behaviors such as excessive barking, aggression, or damage to property.

- Ensure their pet does not interfere with the work environment or safety of others.

- Accept financial responsibility for any damages caused by their pet.

- Remove their pet from the premises if requested due to behavioral issues or employee concerns.

Complaint & Conflict Resolution Process

Employees who experience issues related to pets in the workplace should follow this process:

1. Address concerns directly with the pet’s owner, if comfortable doing so.

2. Report the issue to their immediate supervisor.

3. Escalate concerns to the HR department if the issue is not resolved satisfactorily.

If an employee has a medical or personal issue related to pets (e.g., allergies, phobias), they should notify the HR department.

Service Animals

Service animals, as defined under the AODA, are permitted in all areas where their handler is allowed to go. Employees are not required to provide medical documentation to justify the presence of a service animal. If conflicts arise due to allergies or phobias, the company will make reasonable accommodations to address the needs of all employees while ensuring compliance with accessibility laws.

General Guidelines

- Employees should not feed or handle other employees’ pets without permission.

- Repeated violations of this policy may result in a pet being permanently prohibited from the workplace.

- The company reserves the right to amend this policy as needed to ensure workplace safety, productivity, and compliance with applicable laws.

By implementing this policy, we strive to create a pet-friendly yet inclusive and safe workplace for all employees.